AURA BIOSCIENCES, INC.

85 Bolton80 Guest Street

Cambridge,Boston, MA 0214002135

NOTICE OF 20222024 ANNUAL MEETING OF STOCKHOLDERS

To be held June 15, 202220, 2024

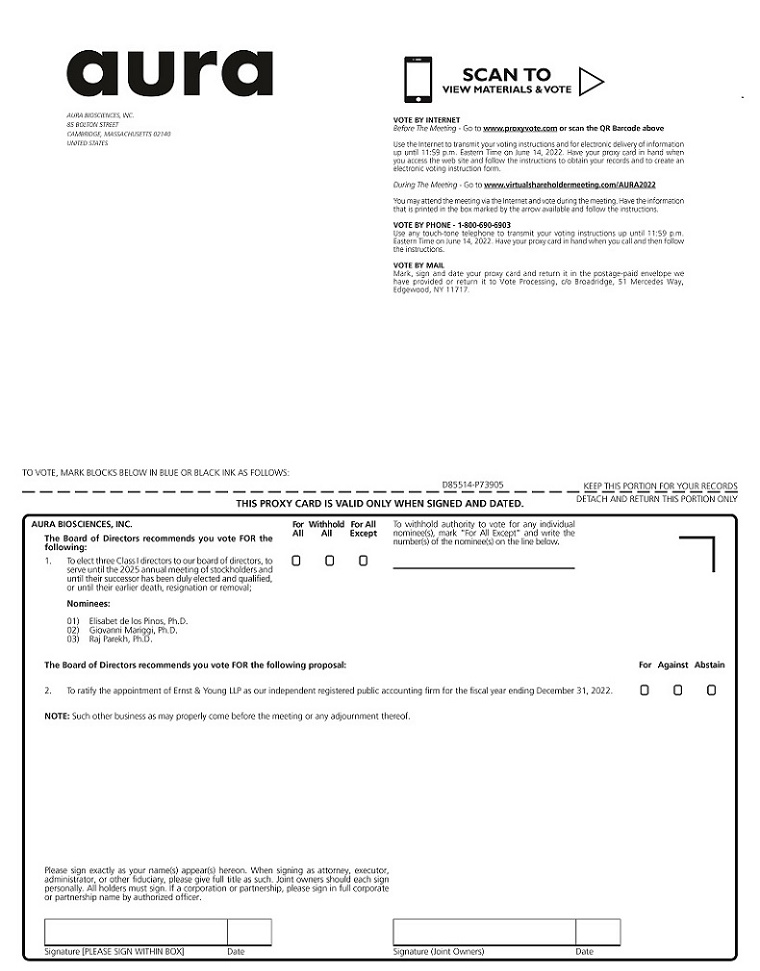

Notice is hereby given that the 20222024 Annual Meeting of Stockholders, or Annual Meeting, of Aura Biosciences, Inc., will be held online on June 15, 202220, 2024 at 10:9:30 a.m. Eastern Time. The safety of our stockholders is important to us, and given the continuing concerns resulting from the COVID-19 pandemic, thisThis year’s Annual Meeting will be held virtually. You may attend the meeting virtually via the Internet at www.virtualshareholdermeeting.com/AURA2022AURA2024 where you will be able to vote electronically and submit questions. You will need the 16-digit control number included with the Notice of Internet Availability of Proxy Materials being mailed to you separately in order to attend the Annual Meeting. The purpose of the Annual Meeting is the following:

| 1. | To elect |

| 2. | To approve an amendment to our Tenth Amended and Restated Certificate of Incorporation to reflect Delaware General Corporation Law provisions regarding exculpation of officers; |

| 3. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

To transact any other business properly brought before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

The proposal for the election of directors relates solely to the election of threetwo Class IIII directors nominated by the boardBoard of directors.Directors.

Only Aura Biosciences, Inc. stockholders of record at the close of business on April 18, 2022,22, 2024, will be entitled to vote at the Annual Meeting and any adjournment or postponement thereof.

Aura Biosciences, Inc. is following the Securities and Exchange Commission’s “Notice and Access” rule that allows companies to furnish their proxy materials by posting them on the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials, or the Notice, instead of a paper copy of the accompanying proxy statement and our Annual Report to Stockholders for the fiscal year ended December 31, 2021,2023, or 20212023 Annual Report. We plan to mail the Notice on or about April 28, 2022,25, 2024 and it contains instructions on how to access both the 20212023 Annual Report and accompanying proxy statement over the Internet. This method provides our stockholders with expedited access to proxy materials and not only lowers the cost of printing and distribution but also reduces the environmental impact of the Annual Meeting. If you would like to receive a print version of the proxy materials, free of charge, please follow the instructions on the Notice.

Please see the “General Information” section of the proxy statement that accompanies this notice for more details regarding the logistics of the virtual Annual Meeting, including the ability of stockholders to submit questions during the Annual Meeting, and technical details and support related to accessing the virtual platform.

Your vote is important. Whether or not you expect to attend the virtual meeting, it is important that your shares be represented. To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the meeting, by submitting your proxy via the Internet at the address listed on the proxy card or by signing, dating and returning the proxy card. Even if you have voted by proxy, you may still vote at the virtual meeting. Please note, however, that if your shares are held through a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

| By order of the Board of Directors, | ||||

/s/ Elisabet de los Pinos | ||||

| Elisabet de los Pinos, Ph.D. | ||||

| Chief Executive Officer | ||||

| Boston, MA | ||||

| April 25, 2024 | ||||

Cambridge, MA

April 28, 2022